Catastrophic Insurance Adjuster: Support for Complex Claims

Catastrophic Insurance Adjuster: Support for Complex Claims

Blog Article

Navigating Cases: Why You Need a Competent Disaster Insurer in your corner

In the aftermath of a calamity, navigating the ins and outs of insurance cases can become an overwhelming task, often worsened by the emotional toll of the occasion itself. A proficient catastrophe insurer is not simply an advocate however an essential partner in making sure that your claims are analyzed accurately and relatively.

Comprehending Catastrophe Adjusters

Disaster insurance adjusters play an essential duty in the insurance industry, specifically in the aftermath of considerable calamities. These specialists focus on handling cases associated with large events such as quakes, wildfires, and typhoons, which commonly result in extensive damages. Their know-how is important for successfully ensuring and examining losses that policyholders get reasonable compensation for their insurance claims.

The key responsibility of a catastrophe insurer is to evaluate the degree of damages to homes, lorries, and other insured assets. This includes carrying out complete inspections, gathering paperwork, and teaming up with numerous stakeholders, including policyholders, specialists, and insurance policy firms. In most cases, catastrophe insurance adjusters are deployed to impacted areas soon after a catastrophe strikes, enabling them to supply prompt help and quicken the cases procedure.

In addition, disaster insurers have to have a deep understanding of insurance plan and regulations to accurately interpret insurance coverage terms and problems. Their logical abilities and focus to information are critical in identifying the authenticity of insurance claims and determining any type of potential fraud. By navigating the complexities of disaster-related claims, catastrophe adjusters play an important function in bring back the financial security of affected people and neighborhoods.

The Claims Refine Explained

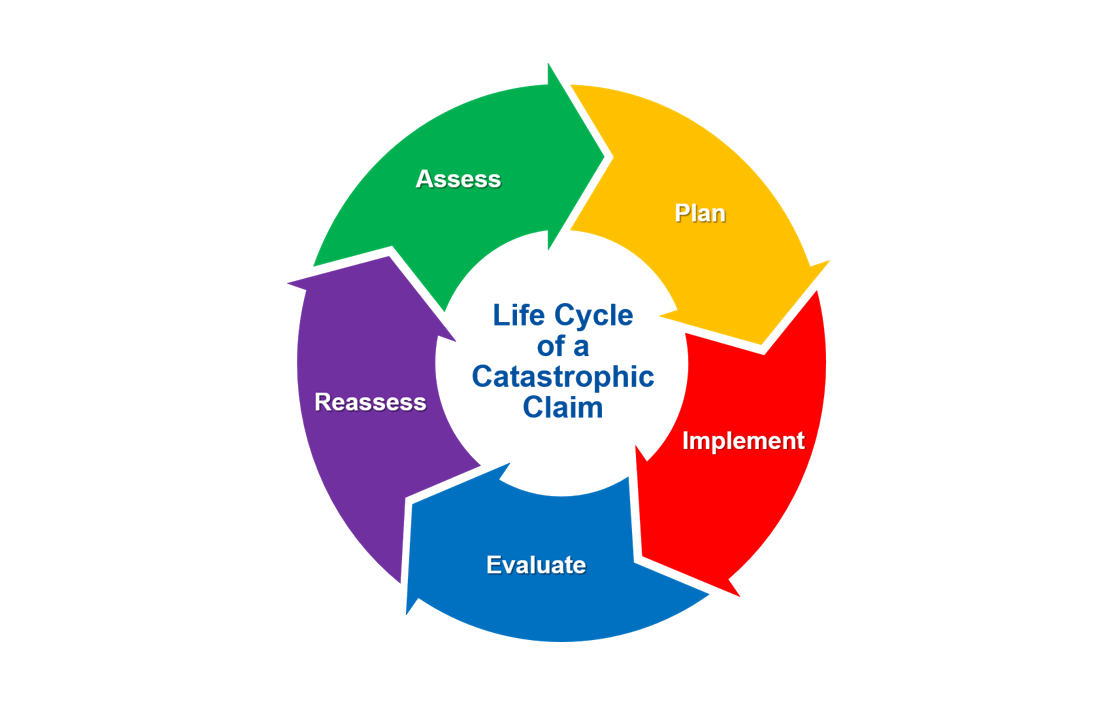

When a disaster strikes, recognizing the insurance claims process is essential for policyholders looking for settlement for their losses. This procedure usually begins with alerting your insurance provider concerning the event, providing them with information such as the date, time, and nature of the damages. Following this preliminary record, an insurance adjuster will be appointed to evaluate your case, which includes examining the loss and establishing the degree of the damages.

Documentation is an essential component of the insurance claims procedure. Once the adjuster has performed their analysis, they will send a record to the insurance business.

After the insurance policy firm assesses the insurance adjuster's report, they will make a choice relating to the claim. Understanding these actions can substantially aid in navigating the intricacies of the insurance claims process.

Benefits of Working With an Insurance Adjuster

Working with an insurance adjuster can offer many benefits for policyholders browsing the claims procedure after a calamity. Among the key advantages is the expertise that a skilled catastrophe insurance adjuster gives the table. They possess in-depth knowledge of insurance plans and case treatments, allowing them to accurately image source assess problems and supporter properly for the insurance policy holder's rate of interests.

Additionally, an insurance adjuster can minimize the stress and complexity associated with submitting a claim. They deal with interactions with the insurance coverage company, guaranteeing that all essential paperwork is sent without delay and appropriately. This degree of organization aids to quicken the insurance claims procedure, lowering the time insurance policy holders should wait on payment.

Additionally, adjusters are experienced at discussing settlements. Their experience permits them to determine all prospective problems and losses, which may not be right away noticeable to the insurance policy holder. This comprehensive assessment can cause an extra desirable settlement amount, making certain that the insurance policy holder receives a reasonable assessment of their insurance claim.

Choosing the Right Insurer

Selecting the appropriate adjuster is crucial for guaranteeing a smooth insurance claims process after a calamity. When encountered with the after-effects of a devastating event, it is important to choose an adjuster that has the right credentials, experience, and neighborhood knowledge. A knowledgeable catastrophe adjuster need to have a solid track document of taking care of similar insurance claims and be skilled in the intricacies of your particular insurance plan.

As soon as you have a shortlist, conduct interviews to assess their communication skills, responsiveness, and readiness to promote for your passions. An experienced adjuster must be clear about the insurance claims procedure and offer a clear rundown of their fees. Trust your instincts-- pick an insurance adjuster with whom you feel comfortable and certain, as this collaboration can considerably influence the result of your claim.

Usual Misconceptions Exposed

Misconceptions about disaster insurance adjusters can lead to confusion and prevent the insurance claims procedure. One common myth is that catastrophe insurers function only for insurer. Actually, lots of insurance adjusters are independent experts who promote for insurance policy holders, making sure reasonable evaluations and settlements.

Another misconception is that hiring a disaster insurer is an unneeded cost. While it is true that adjusters bill costs, their expertise can frequently result in higher claim settlements that much surpass their find prices, eventually benefiting the policyholder.

Some official site individuals believe that all cases will certainly be paid in complete, no matter the circumstance. Nevertheless, insurance plan typically consist of certain conditions that may restrict protection. Comprehending these nuances is vital, and a proficient adjuster can aid navigate this intricacy.

Conclusion

In summary, the participation of an experienced catastrophe adjuster substantially improves the insurance claims procedure complying with a catastrophe. Inevitably, the choice to engage a catastrophe insurer can have a profound effect on the result of insurance cases.

In numerous situations, disaster adjusters are deployed to influenced areas shortly after a calamity strikes, enabling them to provide prompt help and speed up the claims process. - insurance claims recovery

A knowledgeable catastrophe adjuster ought to have a strong track record of dealing with comparable cases and be skilled in the complexities of your particular insurance coverage policy.

Begin by researching prospective insurance adjusters, looking for expert designations such as Qualified Insurance Adjuster or Accredited Claims Adjuster. catastrophe claims.Misconceptions regarding catastrophe insurance adjusters can lead to complication and hinder the insurance claims procedure.In summary, the involvement of an experienced catastrophe insurance adjuster substantially enhances the cases procedure following a disaster

Report this page